Ram Fincorp

Ram Fincorp is an Android finance/utility app for instant personal loans. Apply from your phone, complete KYC, and get up to ₹2 lakh in minutes with flexible repayment terms.

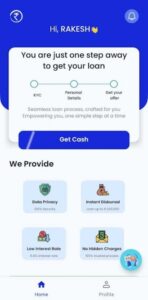

Screenshot

Content writer

Information from ram-fincorp-1

Description

Overview: Ram Fincorp APK

The Ram Fincorp APK is the Android installation file people look for when they want the official lending app on their phone. Here, you’ll get a straight-to-the-point walkthrough of how it works: what it costs, who qualifies, what to watch out for, and how to use it safely so you can make a confident decision without doom-scrolling forums.

Built for salaried users, the app connects to a registered NBFC partner, R.K. Bansal Finance Pvt. Ltd., and runs a fully digital flow—mobile verification, KYC, document upload, and fast approval that often lands within roughly 30 minutes. Credit limits reach up to ₹200,000, tenures typically range from 90 to 365 days, the APR can go up to about 35%, and a processing fee may apply, usually capped near 5%.

Who It’s For, In Plain Terms?

Ram Fincorp fits users who need short-term liquidity for real-life moments—hospital deposits, shifting to a new city, covering rent gaps, or snagging a one-time purchase that can’t wait. If your income is stable and you can map repayments to payday, this option can be practical.

If cash flow is shaky or the shortfall repeats every month, pause and reassess before borrowing. Compare against employer advances, credit cards, BNPL, or your emergency fund, and weigh the total cost, not just speed. A clean repayment rhythm helps your credit profile; missed dues do the opposite.

Eligibility, Limits, and Costs

To qualify, applicants are typically Indian residents aged around 21 to 55 with a minimum monthly income near ₹30,000. Standard KYC includes PAN, Aadhaar, recent salary slips, and bank statements for the last few months. Ram Fincorp communicates pricing transparently in-app: an APR that can reach up to about 35%, a processing fee up to around 5% plus taxes, and late fees if repayment is delayed.

A quick math check helps—on ₹30,000 for three months at roughly 30% per annum, interest lands near ₹2,250, while the processing fee reduces the in-hand amount at disbursal. Always read the final disclosure screen, confirm the total cost of credit, and compare the offer with alternatives before you tap agree.

Application Steps That Save Time

Start with sign-up and mobile OTP verification, then complete KYC and income checks. Keep clean PDFs of your documents so uploads pass the first time. Ensure that your PAN and Aadhaar details match your bank records; name mismatches or unreadable statements can stall approvals.

Ram Fincorp guides you to select a loan amount and tenure that fit your pay cycle, followed by e-agreement and disbursal to your bank account. Before the final confirmation, scan due dates, APR, fees, and repayment method. If your salary date shifts, pick a tenure that gives breathing room rather than pushing repayment to the edge of your cash flow.

Features and Trade-offs

Key Features

The app focuses on speed with a digital screening flow and status updates so you’re not guessing where your application stands. Users can choose EMIs or settle on salary date without collateral, and the dashboard lays out payoff dates, outstanding balance, and support options in clean language. Document requirements are lightweight by design, which helps first-time borrowers move faster. For many, Ram Fincorp offers predictability—you know the amount, the timeline, and the terms upfront.

Pros and Cons

On the positive side, approvals are quick, the interface is straightforward, and repayment windows are flexible enough to line up with payday. On the flip side, unsecured credit is usually pricier than secured loans, first-time limits may be conservative, and eligibility can be tougher for thin credit files or irregular incomes. The smart move is to pick a tenure you can comfortably service, add calendar reminders, and avoid stacking multiple short-term loans that crowd the same paycheck.

Security, Privacy, and Support In Ram Fincorp

The lending partner operates as an RBI-registered NBFC, and you should always verify that name in-app and against the official list before you proceed. Permissions exist for a reason—identity checks, income verification, and bank statement assessment—but they should be limited to the stated purpose.

Never share OTPs, avoid unofficial APK clones, and contact support only through numbers and emails listed on the official site or inside the app. Keep a copy of your e-agreement and the repayment schedule so you can cross-reference dues, interest, and any fees. If something looks off, raise a ticket immediately and document the conversation.

Real Scenarios and Smart Tips

Picture a medical cash gap due next week while payday hits in ten days. A shorter tenure limits interest if your next salary is reliable; set a reminder three days before the due date for safety. Moving to a new city? Budget your EMI after rent, utilities, and commute—then select a tenure that keeps monthly stress low.

Consolidating small dues into one payment can feel cleaner, but only switch if the total cost beats your current mix. Pay early when possible, even a part-prepayment helps trim interest. Automate alerts, track your bank balance on due dates, and check your credit report quarterly to see the impact of your repayment behavior.

Final Thoughts

Used with intention, Ram Fincorp can be a fast, transparent path to short-term funds for salaried users who prefer a fully digital process. Keep the basics tight: confirm the NBFC name, read the rate and fee screens carefully, and select a tenure that respects your monthly essentials. If you’re ready to proceed, download the official, safe APK from APKJaka, review the offer inside the app, and commit only to an amount you can clear on schedule.

Content writer

FAQs

What Is Ram Fincorp APK?

It’s the Android installer for the official Ram Fincorp loan app. Use it to install the app when Play Store access is limited. Stick to official sources to avoid tampered files.Is Ram Fincorp legit and safe?

The app facilitates personal loans via NBFC partner R.K. Bansal Finance Pvt. Ltd. Always verify the NBFC name in-app and on the RBI list before you apply.Who can apply and what docs are needed?

Typically Indian residents aged 21–55 with ~₹30,000+ monthly income. Keep PAN, Aadhaar, last 3 salary slips, and 3–6 months of bank statements ready.How much can I borrow and how fast?

Loan sizes usually range ₹5,000–₹2,00,000. After KYC and checks, decisions can land in ~30 minutes, followed by disbursal to your bank account.What are the costs and tenure?

APR can be up to ~35% p.a.; processing fee up to ~5% + taxes; late fees apply if you miss due dates. Typical tenures are ~90–365 days. Example: ₹30,000 for 3 months at ~30% p.a. ≈ ₹2,250 interest (fees extra).